1000 Woolworths, Coles stores brushing up on bananas

The banana in store education and merchandising program is under way across a combined 1000 Coles and Woolworths supermarkets around Australia.

The program is an investment funded by Banana Marketing and R&D levies aimed at improving the quality of bananas in store, increasing demand through availability and encouraging the ease of shopping bananas at retail level. Strikeforce, one of Australia’s leading field sales and retail marketing groups, was selected as the delivery partner.

The program objectives include:

- Ensuring adequate stock of green and yellow bananas are available, and working with in store teams to ensure regular stock-on-hand levels are appropriate for run rates

- Ensuring correct storage and refilling standards are being employed

- Educating in store staff on best practice standards for both merchandising and handling, which includes watching the ABGC produced training video

- Leaving behind an educational poster to be set up in storeroom to further reinforce optimal practices on an ongoing basis

In just 2 weeks of the 18-week program, 2091 staff members have received face to face training, the training video has been viewed 1368 times, and an additional 1489 cartons of bananas have been replenished by the Strikeforce team.

Availability

Availability is one of the key measures that the team from Strikeforce are collecting data on. When they first get to the banana location, they take a photo of the section and start collecting data points.

The key question the Strikeforce team members are seeking to answer here is, “How would you describe the availability of Bananas in this store? (Full / Partly Full / Almost Empty / Empty)”. As we all know and have frequently witnessed, availability is one of the first issues that catch your eye when visiting local supermarkets. The results below are not surprising for the first couple of visits and we would anticipate that, with a further 16 weeks of the program to go and weekly conversations with the individual produce teams to be had, the scores should trend positively with increased/improved results on the current partly full and full results. The difference between the two retailers is relatively small, however consistent.

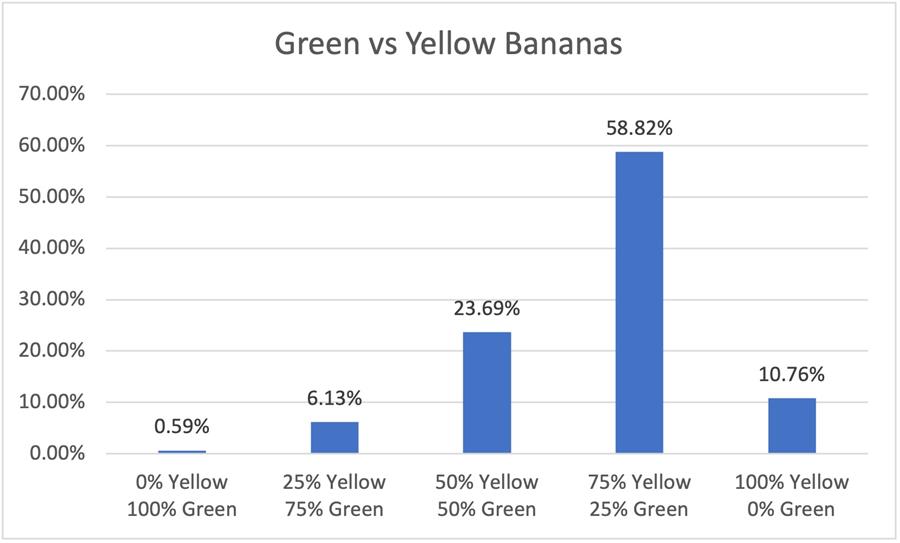

Green Vs Yellow Bananas

Question for this data collection is “Are both “Eat Now and Eat later” bananas available? – If so, how much of each?”

The ideal is having a split of around the 75% yellow level. The results at the time of collecting the data showed that 58% of stores at that time were at the desired level, and additionally highlighted a large variation between the retailers. While this is reflective of the difference in the availability of point-of-sale materials between the two major retailers, there is a definite opportunity here to improve the customer experience from a retail perspective.

Temperature

Question: “What temperature is stock stored at? (refrigerated / ambient / a mixture of both).” It’s important for us and the retailer to know what storage conditions are being used within the stores to maximise both the life and the quality of the bananas.

The results here are mixed however very close between the retailers.

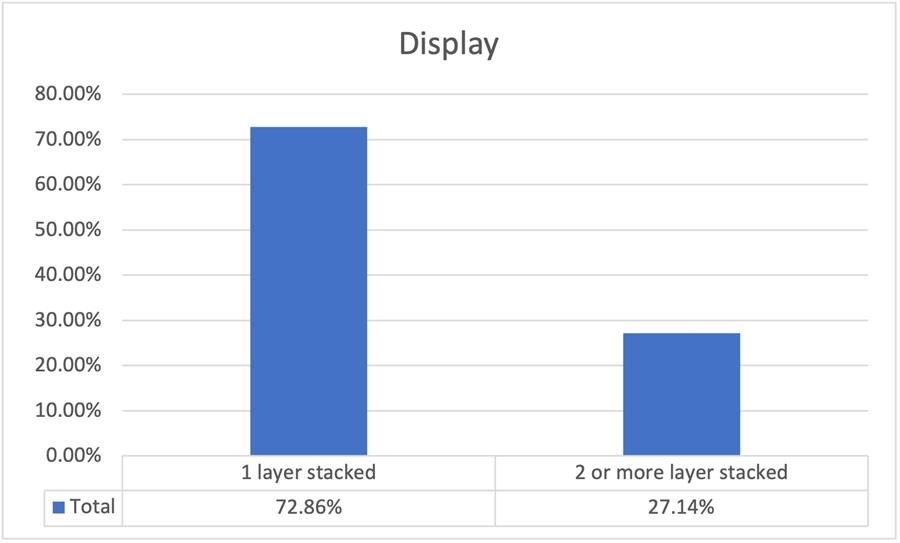

Display

Question: “How are the Bananas displayed? (1 layer stacked / 2 or more layer stacked)”

I’m initially surprised by this result assuming that 1 layer stacked would rate much higher. It will be interesting to see these results by store over time to determine if the space allocated to display bananas is sufficient to hold the sales rates.

Stock Replenished

The final question asked is “How is stock replenished? (tip filled versus hand filled)”, with the results in the high majority completed the correct way, however an area through some discussion and training that should correct the outcome.

There are further survey questions gathering information, the results of which will be shared as part of the final report upon completion of the program.

After the 18 weeks of in store monitoring and reporting, the Customer Marketing team at Hort Innovation and the ABGC will deep dive into the final results and will report those findings along with recommendations back to both the Coles and Woolworths teams. The retailers are eager to understand what the results are informing, and what strategic plans can be implemented to improve the shopper experience for their customers whilst delivering and implementing actions that will drive household penetration and the frequency of purchase, ultimately leading to increased sales.

I will keep you informed of the program results and updates throughout the life of the project.